Natalie Tuchscherer

SVP | Mortgage Lender

Right Now Is The Best Time To Buy

Don’t believe me? Let’s talk about it.

2020-2022 Market

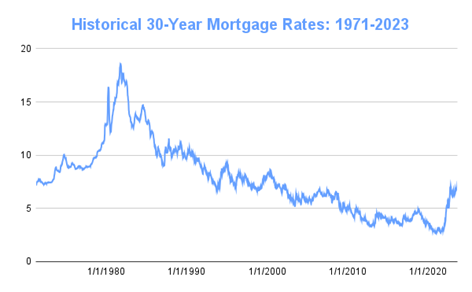

Image from Mortgage Rates Chart | Historical and Current Rate Trends (themortgagereports.com) Source: Freddie Mac PMMS. Click here to read the article on The Mortgage Reports website.

Most people will argue that 2020, 2021, and even 2022 were the best times to buy because the interest rates were half what they are today. But do you want to know what else we witnessed about the market in the last three years?

We saw first-time homebuyers being dominated in the market time and time again. Whether it was bidding wars, all-cash offers, or offers hundreds of thousands of dollars over the asking price. Homes were selling without being toured by the buyer. Inspection and appraisal contingencies were being waived left and right, only for the deal to fall through when things came back or if the home didn’t appraise.

The seller knew they could find another offer – or even had a backup offer – to waive these items. We saw people unable to make their purchases contingent on the sale of their own homes. This meant they needed to qualify with two home payments or add extra loans to secure closing funds on their new home.

Crazy, right? In addition, home emergency repair spending tripled from 2019 to 2020 – and increased even more in 2021. Now tell me, does it still sound like a good time to buy?

Current Market

So why is today’s market better? As a buyer, houses are on the market significantly longer, which gives you MORE buying power. You can negotiate the purchase price or arrange for the seller to cover part or all the potential inspection repairs. You may even be able to agree for the seller to assist in your closing costs, which can potentially help decrease your interest rate.

When interest rates start to decline, you have the option to refinance and lower your payment while capitalizing on the equity that comes with the lower rates.

Remember, when interest rates fall, it will move towards a chaotic seller’s market once again when home prices increase due to buyer demand. Let us help you get into your dream home today.

Ready To Get Started?

Whether you’re ready to get started or just looking to ask a few more questions, we’re ready to help! Call Natalie today at 701.364.2020 or fill out the form below and we will reach out to you shortly.