PERSONAL BANKING

From your first checking & savings, to your first car, home loan, and onto your retirement. All of the products and services of a big bank with the personalized care of a small town one.

Products + Services

Personal Banking with VISIONBank means you get all of the banking products you need paired with the absolute best customer service in town. Our clients mean everything to us; we want to get to know you and your family (including your pets)!

Free Checking

No Minimum Balance Required

No Monthly Service Fees

Ultimate Checking

$400 Minimum Balance Required¹

Variable Rate of Interest Compounded and Credited Monthly²

¹ A service fee of $9 per calendar month will apply if the balance falls below $400.00 on any day in the month. Fees may reduce earnings.

² Interest is earned each day that the required minimum balance is maintained.

Regular Savings

$50 Minimum Balance Required¹

Variable Rate of Interest Compounded and Credited Quarterly²

Money Market Savings

$500 Minimum Balance Required³

Variable Rate of Interest Compounded and Credited Monthly²

Ultimate Money Market Savings

$100,000 Minimum Balance Required⁴

Variable Rate of Interest Compounded and Credited Monthly.

Tiered Rates (Click here)

Youth Savings

No Minimum Balance Required

Only for Ages 18 and Younger. Parent or Guardian Required on The Account.

¹ A service fee of $2 per calendar month will apply if the balance falls below $50.00 any day in the month. Fees may reduce earnings.

² Interest is earned each day that the required minimum balance is maintained.

³ A service fee of $9 per calendar month will apply if the balance falls below $500.00 on any day of the month. Fees may reduce earnings.

⁴ A service fee of $9.00 per calendar month will apply if the balance falls below $100,000 on any day of the month. Variable rate of interest is compounded and credited monthly. Interest is earned on all balances. Fees may reduce earnings.

Auto Loans

Wide variety of financing options for new and used vehicles.

Recreational Loans

We'll finance your boat, motorcycle, RV, or snowmobile.

Home Equity Loan + Line of Credit

Use the equity in your home to secure a home equity loan or line of credit.

Home Loans

We offer financing for construction loans, first time homebuyers, second homes, and more.

Free Checking

No minimum balance required

No monthly service fees

Ultimate Checking

$400 minimum balance required¹

Variable rate of interest compounded and credited monthly²

¹ A service fee of $9 per calendar month will apply if the balance falls below $400.00 on any day in the month. Fees may reduce earnings.

² Interest is earned each day that the required minimum balance is maintained.

Regular Savings

$50 minimum balance required¹

Variable rate of interest compounded and credited quarterly²

Money Market Savings

$500 minimum balance required³

Variable rate of interest compounded and credited monthly²

Ultimate Money Market Savings

Youth Savings

No minimum balance required

Only for ages 18 and younger. Parent or guardian required on the account.

¹ A service fee of $2 per calendar month will apply if the balance falls below $50.00 any day in the month. Fees may reduce earnings.

² Interest is earned each day that the required minimum balance is maintained.

³ A service fee of $9 per calendar month will apply if the balance falls below $500.00 on any day of the month. Fees may reduce earnings.

⁴ A service fee of $9.00 per calendar month will apply if the balance falls below $100,000 on any day of the month. Variable rate of interest is compounded and credited monthly. Interest is earned on all balances. Fees may reduce earnings.

Auto Loans

Wide variety of financing options for new and used vehicles.

Recreational Loans

We'll finance your boat, motorcycle, RV, or snowmobile.

Home Equity Loan + Line of Credit

Use the equity in your home to secure a home equity loan or line of credit.

Home Loans

We offer financing for construction loans, first time homebuyers, second homes, and more.

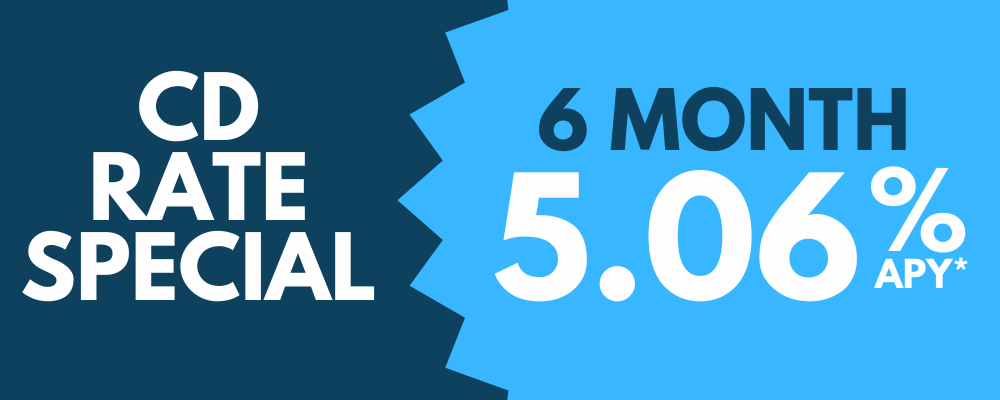

Certificates of Deposit

We offer a wide variety of CDs with competitive interest rates.

*Annual Percentage Yield effective as of September15, 2023. Penalty for early withdrawal may apply.

What Else Can We Help You With?

FAQs

The routing number for all VISIONBank locations is 091311106.

Why #BankWithVISION?

Rated One Of The Best!

Don’t just take our word for it. Our customers have left hundreds of 5-star reviews on Google and Facebook complimenting our friendly team and top-notch banking services. Check out our reviews for yourself!

User Friendly Digital Banking

Our Digital Banking gives you easy and convenient control of your money through online and mobile banking! It allows you to manage your accounts, track your spending, and so much more!

Top-Notch Customer Service Team

Our team will guide you through everything banking and make sure your experience is the best it can possibly be.

WE ARE 100% LOCALLY OWNED.

We are a locally-owned community bank that was started in 2003 by a team of experienced bankers who were committed to providing exceptional service and building an organization that would never lose that small town bank connection to its clients.

Contact Us!

Customer Testimonials

VISIONBank's staff are simply incredible! They are caring, professional. and always going beyond the call of duty. I feel like family each time I stop by. They not only call me by name, ask about my kids.... but they even know my voice when I call them. I can't say enough good things about VISIONBank. It's an experience everyone should have!

Laetitia Hellerud

Dude! The best banking experience ever! Vision has some of the best customer service I've ever seen. When I walk in it makes me feel like I am at my former small town bank where everyone knows everybody by name. I also love how involved they are with the community! A bank that really cares!

Adam Larson